Why Should You Invest in Real Estate?

As someone looking to earn passive income, have you considered real estate investing? The immediate cash flow benefit is only the tip of the iceberg. So why should you invest in real estate? Did you know that, compared to stocks or complicated get-rich-quick schemes, real estate offers much lower risk? It also yields better returns and helps diversify your portfolio.

Tenants PayYour Mortgage

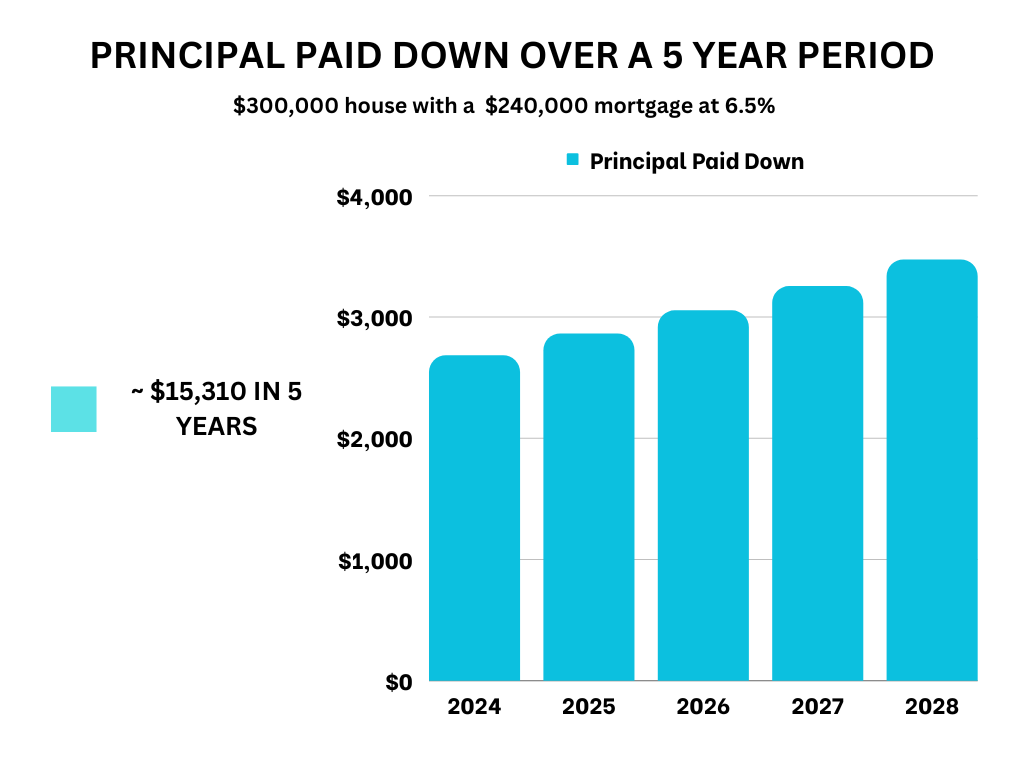

This one may seem like common sense, but should definitely be taken into consideration. If you have a lien on a rental property, tenant rent pays the mortgage. And just like a mortgage on your own house, each payment pays down the principal balance.

How much? Let’s say you have a $300,000 house with a $240,000 mortgage at 6.5% interest. The tenant will effectively pay $15,000 off the mortgage balance in five years. But as amortization scales go, that same rent will pay $36,500 off the principal balance in 10 years.

If you already own a house, you can see how this could pass the napkin test to rent instead of sell.

Let’s Talk Cash Flow

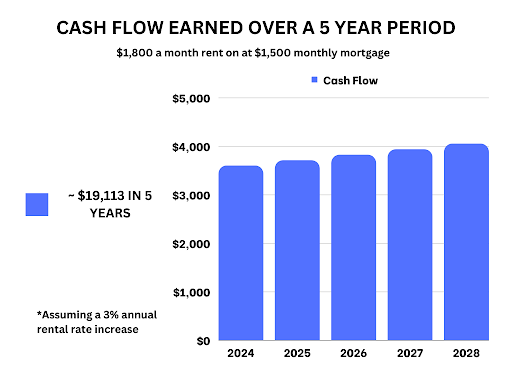

Yes, cash flow is important. In most markets, rent rates outpace mortgage payments, leaving owners, even with liens on their properties, with net positive cash flow.

Say you own a house with a mortgage payment of $1,500, but median rent rates hover at $1,800. Once rented out, you have an immediate $300 monthly cash flow that adds up to $3,600 a year.

But wait there’s more! Rent values in the best areas (and that’s where your investment property is, right?) tend to increase year to year. We find that especially true in periods of intense inflation (ahem – like now).

So in five years from now, if rent rates increase an average of 5%, you may fetch $2,300 rent. Assuming your mortgage stays the same, you now have an $800 monthly cash flow, or $9,600 annually.

But some places have seen rent rates soar as high as 8% (or more). If you increase your rent rate 8% (or $2,645), you’d have $1,145 in monthly cash flow. Now you see $13,740 in annual cash flow.

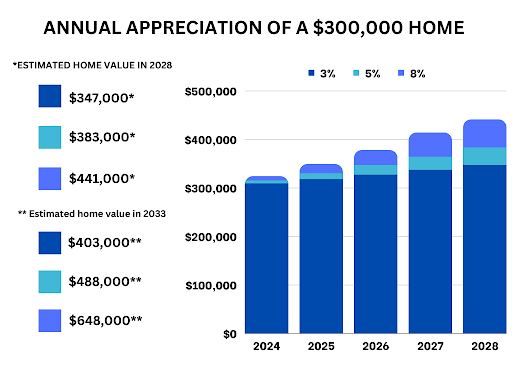

Appreciate Real Estate Appreciation

But investing in real estate entails more than just immediate cash flow benefits. You also benefit from the positive equity in the property. As a rule of thumb, Florida properties appreciate in value roughly 8% annually. Some recent wild days in 2021 and 2022 saw appreciation skyrocket to 10% or even 20%.

But what does this mean for the average property owner?

Say you buy a house today worth $300,000 with the Florida average 8% appreciation. Every year it will gain roughly $24,000 in value. In those wilder markets, you’d see $30,000 (10%) or even $60,000 (20%) annual appreciation.

But let’s stay at a more conservative 5% appreciation rate. The same house you bought for $300,000 today would be worth $82,884 in five years. In 10 years, it could be worth $488,668 at 5% appreciation and $795,989 after 20 years!

One wildly popular way to utilize this equity is the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method. In this way, you borrow from the equity of one rental to purchase another one and further boost your passive income potential.

Interested in learning more? Contact our team at 321-947-7653 or complete our online form to talk to see if real estate investing might be right for you. We look forward to servicing your Central Florida and greater Orlando property management needs.