Home Mortgage Rate Volatility

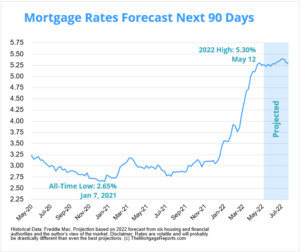

There’s one thing we are learning about home mortgage rates in 2022: they’re going to be extremely volatile. The inevitable rise of rates with ongoing inflation have been predictable. However, this past week, mortgage rates actually went down from 5.30% to 5.25% for 30-year loans and 4.48% to 4.43% for 15-year loans. Though it seems promising in the short term, the Federal Reserve anticipates six more interest rate increases throughout the year. The good news? The predicted home mortgage rate is expected to be approximately 4.3% by the end of the year. Let’s delve deeper into this hot topic. Note that this is by no means financial advice more than it is our interpretation of the data with other expert’s findings.

Home Mortgage Forecasts

So what does that mean for you? You need to be exceptionally strategic, especially as a first-time homeowner. It’s no secret that the summer months are typically prime time for future homeowners to look for their first home. That’s why the anticipation to see interest rates rise for the highest percentage amount in two decades is likely going to happen. As mentioned, the data shows you can take a risk being patient and hope that the 4.3% mortgage rate happens later in the year. The fact a lot first-time homebuyers have already been priced out of the market with the mortgage rate increase may reduce buyer confidence. However, home sales are still looking at outperforming pre-pandemic sales nationally. Regardless, cash-only investors within Florida are still readily watching closely as the Florida rental market continues to be a gold mine.

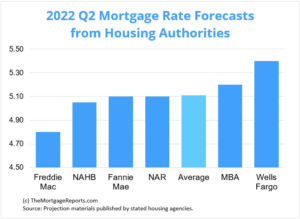

As seen from a few forecasts above, it only confirms the level of uncertainty of mortgage rate volatility. Timing will be especially important for first-time buyers or loan-approved investors. The temporary rate drop we recently saw last week creates a “get in while it’s still sort of low” mindset based on the forecasts.

Buy, Sell or Hold…that is the Question

Buy?

It depends on your goals and where you’re at in life. For first-time buyers, it is especially important to get in before the rates go up and inventory continually reduces. The unknown volatility and economic factors can impact buyer confidence. However, Florida housing prices are not projected to go down any time soon. What you may think you can save in interest rates will NOT offset with rising housing costs. Stay informed daily about the rates and forecasts, especially as a first time buyer. Economic factors can influence rates rather quickly.

Sell?

Selling would be the least recommended during this time. Florida has five of the top ten most growing markets for year-over-year housing pricing gains. Consider renting before you sell. There are plenty of property management companies that will guide you with rental prices and affordably manage the house for you. Though everybody has a different strategy, and selling isn’t necessarily wrong. As anyone would tell you, it depends on your goals and where you’re at in life.

Hold?

No, this is not even close to the cryptocurrency strategy to “hodl.” The best thing about real estate is the ACTUAL appreciation of your asset. Now imagine that appreciation being extremely accelerated and only increasing your wealth. That’s exactly what’s happening in Florida right now. Holding or renting out while you own are the two best long-term money options. A lot of people are continually moving from Connecticut, New Jersey and New York, which is only helping drive up demand. Mix that with low inventory? Yes, this is a gold mine opportunity to be doing anything but selling in this moment. So definitely hold your Florida residential property and reward yourself by gaining more wealth each year.

Conclusion

The home mortgage industry is a very hot topic, especially this year. Know and understand your goals. If unsure, you can always ask an expert. The Realty Medics can help you better understand your goals and provide recommendations if you’re still unsure whether you want to buy, sell or hold onto your Florida residential property.