When real estate investors are looking to purchase a new rental property, they have to take personal preferences out of the equation and focus on understanding what tenants want. Instead, they need to understand their client base’s demographics and which amenities they want. If you’re looking to buy an Orlando area rental property, how do you know if it offers what ideal tenants want?

Know Your Client Base

While every Central Florida neighborhood has different draws, property owners should focus on what attracts the best tenants. One in three adults in the United States rents their home. The ideal renters pay on time, keep the property well-maintained, and rarely cause problems for their neighbors.

In return, property owners need to provide a rental that they can afford and one that addresses their specific wants and needs. When looking for new rental homes, investors should look for properties that would appeal to the highest percentage of the rental population.

Knowing the general renter population’s age, income, and education level can help owners understand what their target market needs in a rental home. The percentage of renters with significant others, children, and/or pets also puts some perspective on what’s important to someone looking for a new rental home.

To find out, in 2023, Zillow surveyed over 21,000 renters in the United States about their backgrounds and preferences. Here’s what they found:

Age

- 47%: 18-29 years old

- 23%: 30-39 years old

Annual Income

- 48%: Less than $50k

- 30%: $50-100K

- 22%: Over $100k

Education

- 47%: High school diploma or less

- 26%: Some college

- 28%: Four-year degree

Relationship Status

- 52%: Married

- 30%: Never married

- 19%: Divorced / separated / widowed

Kids and Pets

- 59%: Have a pet

- 33%: Kids under 18

- 40%: Have dogs

- 32%: Have cats

In summary, the vast majority of your potential renter base are under 40 years old, have a pet, and make less than $100k.

How does this information help you as you look for new rental property? Most apartment complexes and property management companies require that tenants make three times the rental amount in gross monthly income. If your property is listed at $2700 a month, only about 22% of potential renters would qualify, and that percentage would decrease as the rental rate increases. Conversely, more than half of renters could afford $1500. It’s important to note that the median rental rate for a single-family home in Orlando is $2,089. At The Realty Medics, we encourage our investors to look for properties where the rental rate will cast a wider net of potential tenants, minimizing vacancy times.

What Tenants Wants

Without question, nearly every tenant (94%) considered staying within their budget “essential” when looking for a new rental home, and the vast majority of them (91%) use online resources to complete their search. Someone searching for homes often filters results according to monthly rent payment, and those search parameters are often in $200-$250 increments. That means overpricing rental rates above the market rent for that area will lead to your property not even showing up in the tenant’s search results.

Providing what your ideal tenants want builds demand, resulting in shorter vacancy periods and higher returns on investment. What type of dwelling do they want? Why do they look at specific neighborhoods?

Renter Priorities

- 94%: Essential to stay within budget

- 84%: Number of bedrooms

- 69%: Number of bathrooms

- 70%: Floor plan / layout

- 45%: Newly built / renovated house

Type of Rental Property (Current vs Ideal)

- Apartment: 51% currently; 54% ideally

- Single-Family Home: 29% currently; 35% ideally

- Townhome: 7% currently; 10% ideally

- Duplex/Triplex: 6%

- Room in a shared house: 2%

Half of renters prefer an apartment, many for the on-site amenities. While many of those amenities cannot be provided with a single-family home, that doesn’t mean there aren’t amenities a single-family homeowner can provide. For example, one of the most common reasons we at The Realty Medics see tenants moving from an apartment to a single-family home is more space. Whether it be for their children or pets, a fenced-in yard can provide the space and convenience that an apartment cannot.

Neighborhood Characteristics

- 59%: Commute to work/school

- 56%: Close to shopping/services/leisure activities

- 39%: Close to family or friends

- 37%: Close to public transportation

Where Do Renters Go When They Move?

- 40%: Same city, different neighborhood

- 19%: Same metro, different city

- 15%: Same state, different metro

- 12%: Same neighborhood

Leasing Options/Expectations

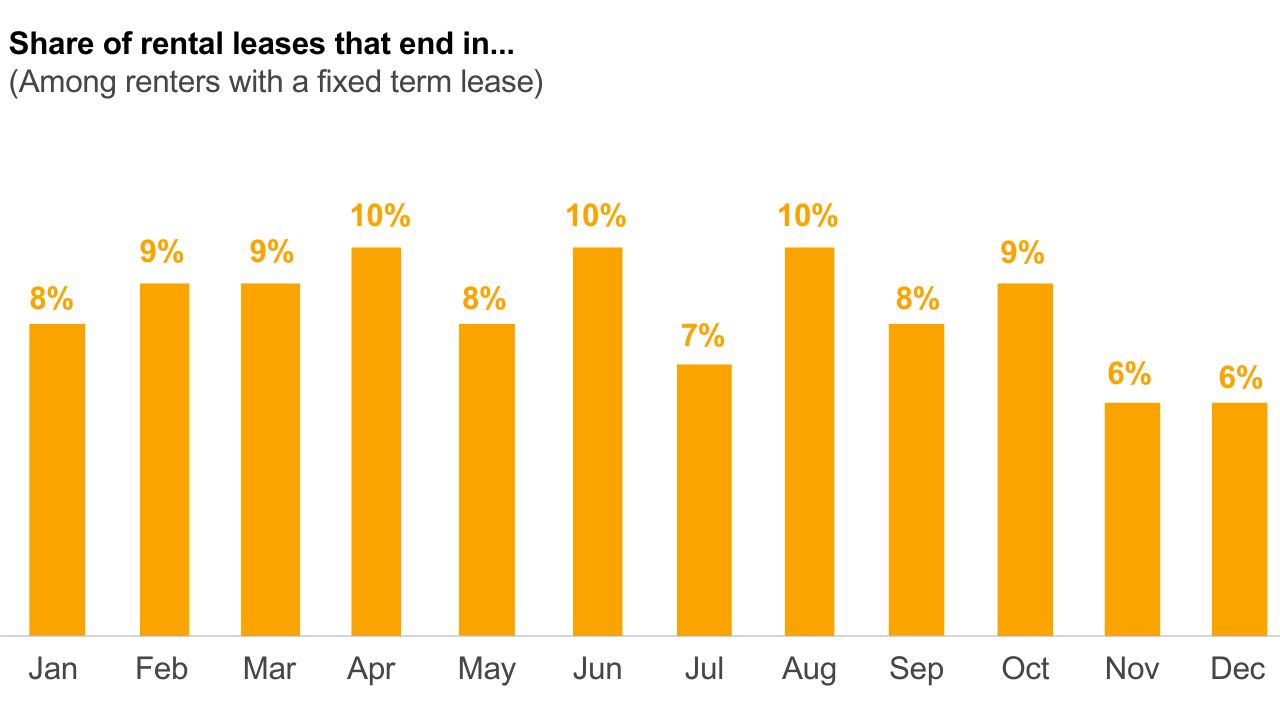

Once you’ve attracted the right tenant candidates with the right rent rate, location, and amenities, what options do they expect? The best candidates will shop around and have lease option expectations… and may still have plans to move soon anyway. You can even see what time of year potential rents will be more likely to look for a place based on lease expirations.

Submitted Applications

- 13%: Did not submit an application

- 21%: Submitted 1 application (down from 32% in 2022)

- 66%: Submitted 2 or more applications

Paid Security Deposits

- 87%: Paid a security deposit

- 22%: Paid more than $1,000 for a security deposit

- 42%: Received all their security deposit back

- 20% received “most” of the security deposit back

Lease Duration

- 67%: 12-month lease

- 20%: Longer than 12-month lease

- 11%: Two-year (or longer) lease

- 13%: Shorter than 12-month lease

Note: 87% of renters are on a lease of 12 months or greater. Some investors inquire about mid-term leases (6-8 months) for traveling nurses or corporate rentals, but in our experience that market is much smaller than people believe, as supported by the data. Not only is the mid-term rental tenant pool much smaller than the long-term population, it’s better from an investment perspective because less frequent vacancy periods reduces unit turn costs.

Paying Rent

- 69%: Want to pay online

- 60%: Pay online

- 34%: Want to pay in person

- 27%: Pay in person

Plan to Move from Current Rental

- 61%: Plan to move within three years (44% of those planning to move in three years intend to buy)

- 29%: Might move in the next year

- 25%: Currently considering moving

- 15%: No plans to move

Combining this data with our experience, we can provide some opinions. Tenants in good living situations do not typically move unless they have a life-changing event (Job relocation, buying a house, etc). If the landlord provides a healthy landlord/tenant situation they are more likely to stay longer, and thus, improve the investment’s profitability by delaying when vacancy periods occur. However, if the landlord is unresponsive, does not address issues promptlywell maintained, and is constantly raising the rent by a substantial amount, it may push the tenant to decide to move. Moral of the story… don’t be the reason your tenant moves out.

Lease Expiration

- The highest number (10%) of leases that expire in April, June, and August

- The lowest amount (6%) of leases that expire in November and December

This is not to say you should plan when to list your property around this information, but rather something to consider when you do list. If there are few vacant rentals in your area, but more people moving, it means you are more likely to command higher rental rates with a well-prepared rental property.

Takeaway

To attract the best tenants, consider these data points as you look for new rental property in the greater Orlando area. Better yet, don’t leave your decision to chance: ask the rental realtor experts at The Realty Medics. As Orlando’s premier home sales team, The Realty Medics can offer advice and show you deals to consider and which ones to shy away from. Find your new investment property today by calling 321-947-7653 or completing our online form.